par financeparticipative.org | 7 Déc 2023 | Interview, Réglementation, Fintech

FPF a organisé le 23 novembre dernier une rencontre autour d’un petit-déjeuner avec Paul Midy, député de Paris-Saclay, rapporteur général du projet de loi Numérique. Cela a été notamment l’occasion de revenir sur le rapport qu’il a rédigé dans le cadre de...

par financeparticipative.org | 21 Sep 2022 | Evénement, Actu, Crowdfunding, Fintech

Financement Participatif France vous convie, le 14 février 2023, à l’événement phare du crowdfunding européen au 104, à Paris : The Place to crowd ! 10 ans que Financement Participatif France existe, pour contribuer à la promotion du crowdfunding, faire évoluer le...

par financeparticipative.org | 18 Fév 2021 | Evénement, Réglementation, Actu, Panorama du crowdfunding, Crowdfunding, Fintech

Le 11 février 2021, Financement Participatif France et Mangopay ont lancé le 1er webinar The Place to crowd by FPF. Animé par Charlie Perreau, journaliste au Journal du Net, cet événement fut l’occasion de revenir sur le développement du secteur du financement...

par financeparticipative.org | 24 Jan 2019 | Médias, Actu, Panorama du crowdfunding, Crowdfunding, Fintech

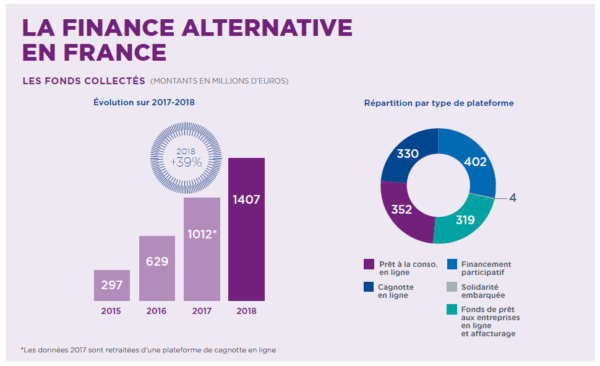

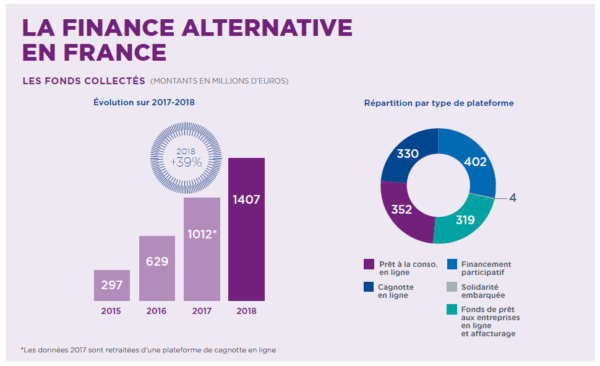

Communiqué de presse – Paris, le 24 janvier 2019 La finance alternative en France — Avec 1,4 milliard d’euros de fonds collectés en 2018, le seuil du milliard d’euros est très largement dépassé — Le financement alternatif des entreprises progresse de 31 %,...

par financeparticipative.org | 4 Déc 2018 | Fintech, Business, Evénement, Actu

Depuis plus d’un an, Financement Participatif France (FPF) a travaillé aux évolutions nécessaires de son organisation pour s’adapter aux changements de l’environnement dans lequel les acteurs du crowdfunding interviennent (réglementaires, sociologiques,...

par financeparticipative.org | 9 Mar 2018 | Europe, Crowdfunding, Fintech, Réglementation, Actu

Jeudi 8 mars, la Commission européenne a publié sa proposition pour une réglementation européenne du crowdfunding. Cette annonce s’inscrit dans une volonté de faire de l’Union européenne, un « Centre mondial des Fintech » et d’établir un « Capital Market Union »[1]....